DIY Debt Validation: A Step-by-Step Guide to Protecting Your Finances

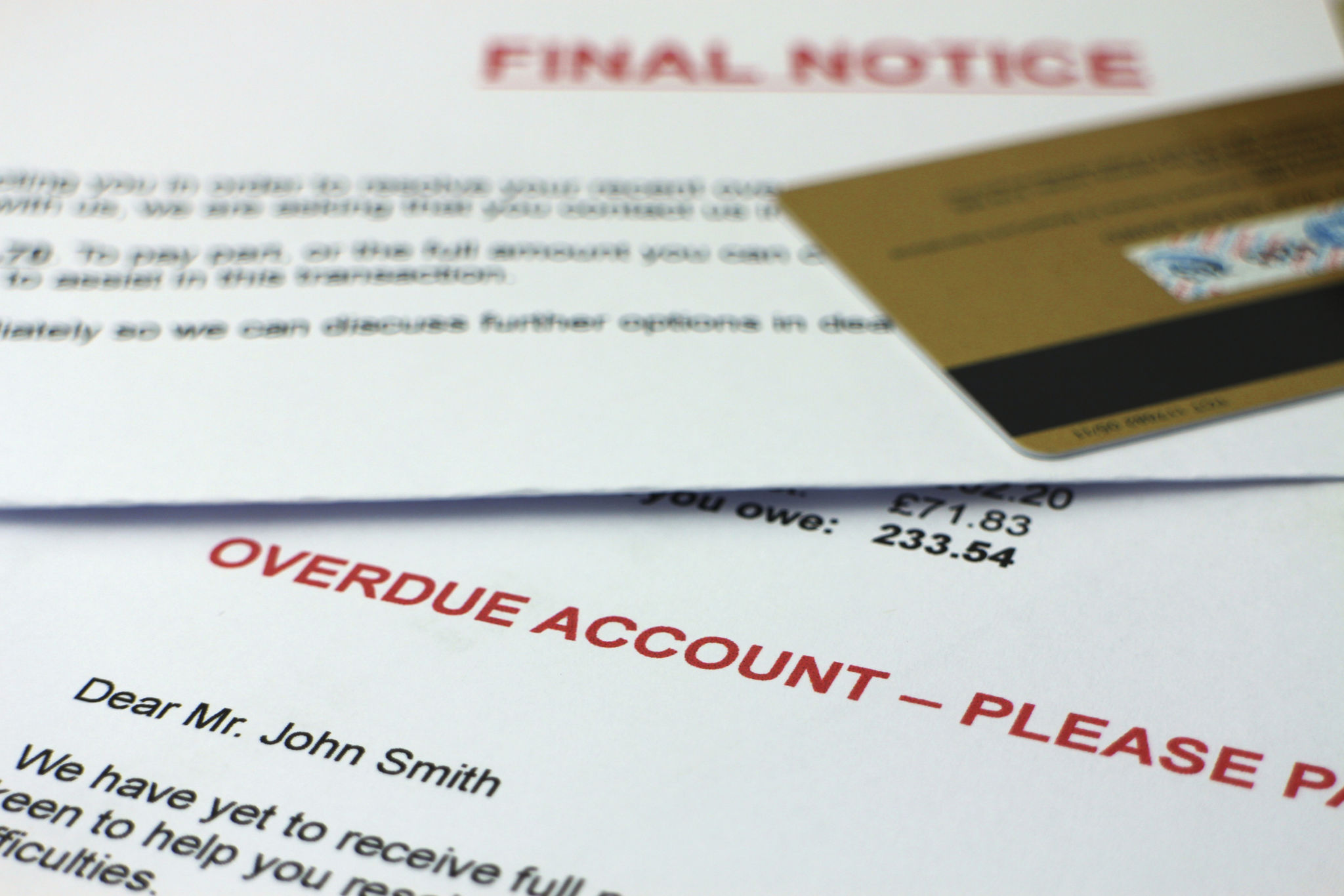

In today's fast-paced world, managing finances can be a daunting task, especially when it comes to dealing with debt collectors. One of the most effective tools at your disposal is debt validation. This process empowers you to challenge and verify the legitimacy of a debt, ensuring that you only pay what you truly owe. Whether you're dealing with a persistent creditor or simply double-checking your records, understanding how to validate a debt can safeguard your finances.

Understanding Debt Validation

Debt validation is a legal right under the Fair Debt Collection Practices Act (FDCPA) that allows consumers to request verification of a debt from collectors. When you receive a collection notice, the first step is to ensure the debt is legitimate. This process not only protects you from fraudulent claims but also provides clarity on your financial obligations.

Step 1: Gather Your Information

Before contacting a debt collector, gather all relevant information regarding the debt in question. This includes any previous correspondence, billing statements, and records of payments. Having this information at hand will make it easier to identify discrepancies and discuss the matter with the collector.

Start by reviewing the original creditor's name, the amount claimed, and any documentation you've received. Make sure to note down all relevant dates and details, as these will be crucial when requesting validation.

Step 2: Send a Debt Validation Letter

Once you've gathered your information, it's time to send a debt validation letter to the collector. This formal request should be sent within 30 days of receiving the collection notice. The letter should clearly state your request for validation and include your contact information. Be polite but firm in your tone.

- Include your full name and address.

- Request detailed information about the debt.

- Ask for proof that the collector is authorized to collect the debt.

- Send the letter via certified mail to ensure it's received.

Step 3: Review the Collector's Response

After sending your letter, the collector is required by law to provide evidence of the debt's validity. This typically includes details such as the amount owed, the original creditor's name, and proof of their authority to collect. Carefully review any documents they send and compare them with your records.

If the collector fails to provide adequate validation or doesn't respond within a reasonable timeframe, they must cease collection efforts. Keep copies of all correspondence for your records in case further disputes arise.

Protecting Your Financial Future

By taking charge of the debt validation process, you're actively protecting your financial well-being. This proactive approach not only prevents unwarranted payments but also strengthens your understanding of personal finance management. Remember, knowledge is power when it comes to handling debts.

In addition to validating debts, consider establishing a budget and seeking advice from financial professionals to further safeguard your finances. With these strategies in place, you'll be better equipped to navigate any financial challenges that come your way.