Understanding Debt Validation and How It Protects You

What is Debt Validation?

Debt validation is a process that allows consumers to challenge and verify the legitimacy of a debt that a collection agency claims they owe. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to ask a debt collector to provide evidence that the debt is yours and that they have the right to collect it. This process is crucial because it serves as a safeguard against paying debts that might be incorrect, fraudulent, or already paid.

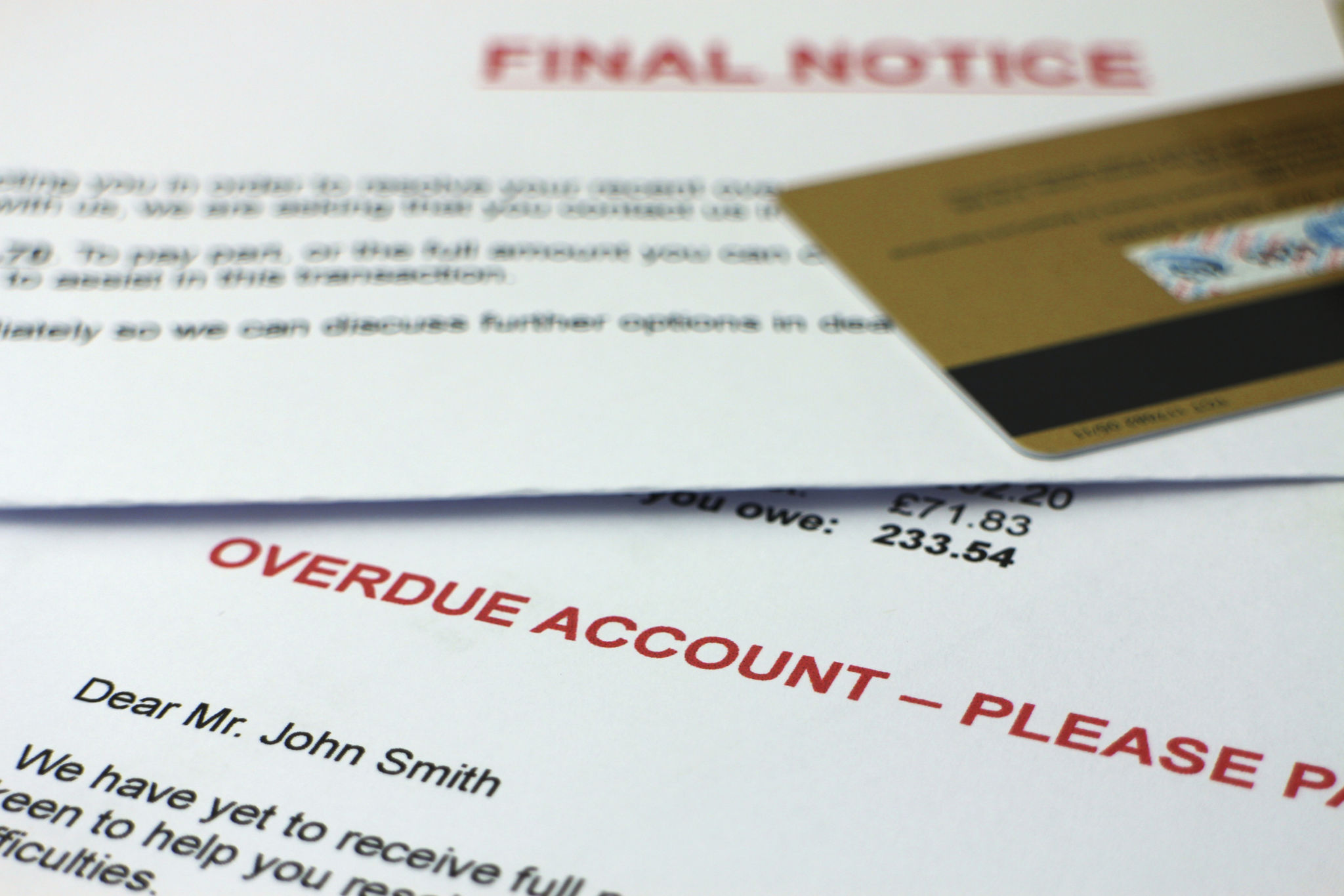

When you receive a collection notice, you should not panic. Instead, take advantage of your right to request debt validation. The collection agency is obligated to provide documentation that includes the original creditor's name, the amount owed, and proof that they are authorized to collect the debt.

How to Request Debt Validation

Requesting debt validation is a straightforward process. As soon as you receive a notice from a debt collector, you should send a written request for validation. It's important to do this within 30 days of receiving the initial contact from the collector. Failure to act within this timeframe might result in losing some of your rights under the FDCPA.

Your request should include your contact information, a statement that you do not recognize the debt or need more information about it, and a request for verification details. Always send this letter via certified mail with a return receipt requested to have proof of your request being received.

What to Expect After Requesting Validation

Once your request is received, the debt collector must cease collection efforts until they provide you with the requested information. This means no more calls or letters until they have verified the legitimacy of the debt. If they are unable to validate the debt, they must stop trying to collect it altogether.

If the debt is validated, review the documents carefully. Ensure that all details match your records and that there is no error or fraudulent information. If discrepancies exist, you may need to seek legal advice or contact the original creditor for clarification.

The Importance of Debt Validation

Debt validation protects consumers from unfair practices by ensuring that any debt being collected is legitimate and accurate. Without this process, individuals could be misled into paying debts they do not owe or are not responsible for. It also helps prevent cases of mistaken identity or identity theft from affecting your financial standing.

Common Issues with Debt Validation

While debt validation is a powerful tool, some common issues may arise. Collectors might delay in providing validation or send incomplete information. In such cases, it's essential to know your rights and perhaps seek assistance from consumer protection agencies or legal professionals.

Understanding your rights under the FDCPA can empower you to handle these situations with confidence. Remember that harassment or threats from collectors during this process are violations of your rights and should be reported.

Conclusion

Understanding and utilizing debt validation can be a crucial step in managing your finances responsibly. It offers an effective way to ensure that any debts you pay are legitimate and helps protect against errors or fraudulent claims. Always remain informed about your rights and take proactive steps when dealing with debt collectors to safeguard your financial well-being.